More Commuters Can Benefit from a Hassle-Free Public Transport Experience

1. Following a successful pilot of the Account-Based Ticketing (ABT) System to trial the use of Mastercard contactless credit and debit cards for public transport fare payments, the Land Transport Authority (LTA) will be expanding the pilot to NETS and Visa in December 2018. This means that more commuters will get to enjoy the convenience of paying for public transport rides without the need to carry an extra travel card or top up their cards, similar to how contactless transactions are made at retail merchants. The expansion will also allow LTA and its partners to improve inter-operability with these cards before LTA introduces ABT to all commuters with contactless bank cards in the future. This initiative ties in with one of the key projects under Singapore’s Smart Nation effort – E-Payments, and taps on digital payments technology to provide commuters with a more seamless travel experience.

2. Mr Ngien Hoon Ping, Chief Executive of LTA, said, “We are pleased to extend the pilot to NETS and Visa, which will allow even more commuters to try and experience ABT, especially the convenience it offers. The trial for Mastercard has been very encouraging so far, and I am confident that the Visa and NETS trials will be equally helpful in fine-tuning the ABT system before we launch it to the public in future.”

Pilot with NETS Contactless

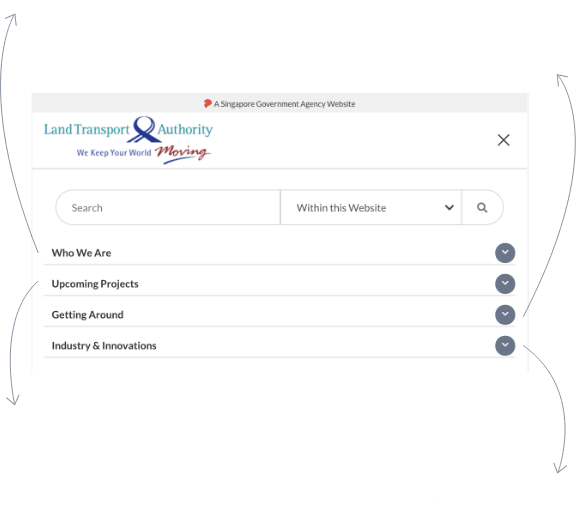

3. Commuters who hold NETS Contactless Bank Cards with DBS/POSB, OCBC and UOB and are interested to take part in the pilot will be able to register their interest at http://www.nets.com.sg/netsintransit from 3 December 2018.

4. Mr Jeffrey Goh, Group CEO, NETS, said, “With this pilot, NETS Contactless Cardholders can now pay for all their daily essentials, such as food, groceries and now public transport, with just their NETS Contactless Bank card. In addition to enjoying the convenience of tapping to pay at over 110,000 acceptance points island-wide, which includes more than 4,000 hawker centres and canteen stalls, NETS Contactless Cardholders no longer have to key in a PIN for transactions less than $100.”

Pilot with Visa

5. The pilot will be limited to an invited group of employees from Visa and participating banks[1]. Invited participants will be informed by Visa or their respective banks to register on the TransitLink ABT Portal (https://www.transitlink.com.sg/ABT) or TransitLink mobile app from 3 December 2018.

6. “Visa commissioned a transit study recently and based on the findings, we are confident that Singaporeans will embrace the benefits of contactless payments for transit given the high contactless payments penetration in the country. Close to 7 in 10 Singaporeans state that the top benefit of using contactless payment for transit is that they no longer need to use cash or top up their stored value cards to pay for their rides. Visa has a successful history of supporting public transport and delivering contactless payments acceptance in the mass transit industry globally. We are excited to kick off this pilot with LTA to transform the commuter experience in Singapore,” said Kunal Chatterjee, Visa Country Manager for Singapore & Brunei.

Updates on the Mastercard ABT Pilot

7. Commuter receptiveness to ABT has been encouraging, with over 100,000 participants in the Mastercard pilot since March 2017. More than 26 million trips have been transacted via ABT, with an average of over 50,000 trips daily. The Mastercard pilot has enabled LTA to enhance the ABT System and user experience. For instance, LTA has worked with TransitLink to add new features to the mobile app, such as allowing users to opt in to receive push notifications for trip fares.

8. Said Ms Adeline Goh, a Mastercard ABT pilot user: “Nowadays, I simply tap my Mastercard at the fare gates, there is no need to top-up or worry about insufficient balance in my travel card, especially since I have to take a bus to the MRT station to top-up. It is also very convenient for me to check my transactions and track my transport expenditure on the TransitLink ABT Portal.”

9. Mastercard users who are interested to sign up for the Mastercard ABT pilot can continue to do so via the TransitLink ABT Portal (https://www.transitlink.com.sg/ABT) or TransitLink mobile app.

* * *

About Account-Based Ticketing (ABT)

ABT allows commuters to enjoy a “tap and go” fare payment experience by simply tapping their contactless credit or debit card on the bus or MRT fare readers, and without the need for upfront top-ups. Commuters will be charged for their public transport rides in their credit or debit card bill, similar to the experience for contactless transactions made at retail merchants.

LTA is working towards a public transport system fully supported by e-payment methods, where credit and debit cards will double up as travel cards, reducing the number of cards that commuters need to carry. ABT will be a key pillar in our journey to enable commuters to have an easy and convenient way to adopt e-payments as a way of life.

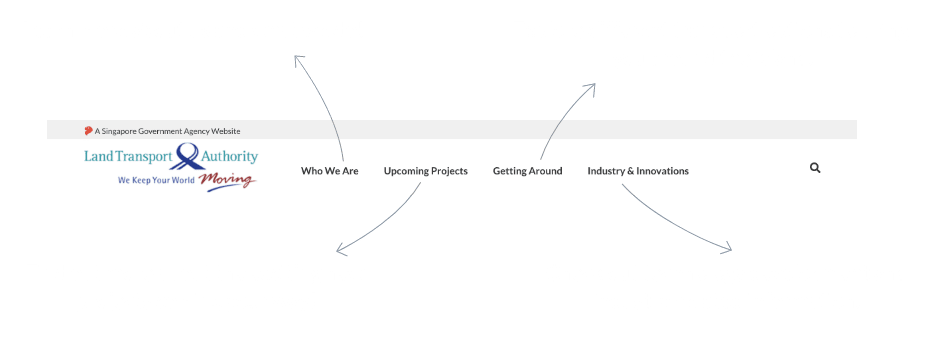

About the Land Transport Authority (LTA)

The Land Transport Authority (LTA) is a statutory board under the Ministry of Transport. LTA plans the long-term transport needs of and spearheads land transport developments in Singapore. While serving commuters by providing an integrated and user-friendly transport system, LTA addresses wider issues such as sustainable development, economic growth, and community life. LTA looks forward to working with leading companies to develop innovative transport solutions, and making Singapore's land transport system more convenient, more seamless, and more people-centred.

About NETS

The NETS Group is a leading payments services group, enabling digital payments for merchants, consumers and banks across the entire payments value chain.

The Group operates Singapore’s national debit scheme enabling customers of DBS Bank/POSB, HSBC, Maybank, OCBC Bank, Standard Chartered Bank and UOB to make payments using their ATM cards or mobile devices at more than 110,000 acceptance points in the country as well as online payments. The NETS network also accepts NETSPay, UnionPay and BCA cards, and includes 47,000 Unified POS terminals and 66,000 QR acceptance points. NETS is also the issuer of CashCard and Flashpay cards.

The NETS Group manages and operates the clearing and payment infrastructure for the Singapore Clearing House Association and core electronic transfer services FAST, Inter-bank GIRO and PayNow.

It is the market leader for payment and clearing solutions (Real-Time Gross Settlement system and Cheque Truncation System) in the region with some S$1 trillion in transaction value processed through its systems every year.

NETS is a member of the Asian Payment Network and a council member of UnionPay International.

For more information on the NETS Group, please visit www.nets.com.sg.

About Visa

Visa Inc. (NYSE: V) is a global payments technology company that connects consumers, businesses, financial institutions, and governments in more than 200 countries and territories to fast, secure and reliable electronic payments. We operate one of the world's most advanced processing networks — VisaNet — that is capable of handling more than 65,000 transaction messages a second, with fraud protection for consumers and assured payment for merchants. Visa is not a bank and does not issue cards, extend credit, or set rates and fees for consumers. Visa's innovations; however, enable its financial institution customers to offer consumers more choices: pay now with debit, pay ahead of time with prepaid or pay later with credit products.

[1] Bank of China, Citibank Singapore Limited, CIMB Bank, DBS Bank Limited, HSBC Bank (Singapore) Limited, ICBC Limited, Maybank Singapore Limited, Standard Chartered Bank (Singapore) Limited, United Overseas Bank Limited, OCBC Bank