Increased rebates will apply on top of Electric Vehicle Early Adoption Incentive

for fully electric cars and taxis

Singapore, 12 November 2020 – To further promote the adoption of cleaner vehicles and to discourage purchases of more pollutive models, the current Vehicular Emissions Scheme (VES) for new cars taxis and imported used cars, will be enhanced with increased rebates and higher surcharges. The enhanced scheme will take effect on 1 January 2021, when the current VES expires at the end of this year, and last till 31 December 2022.

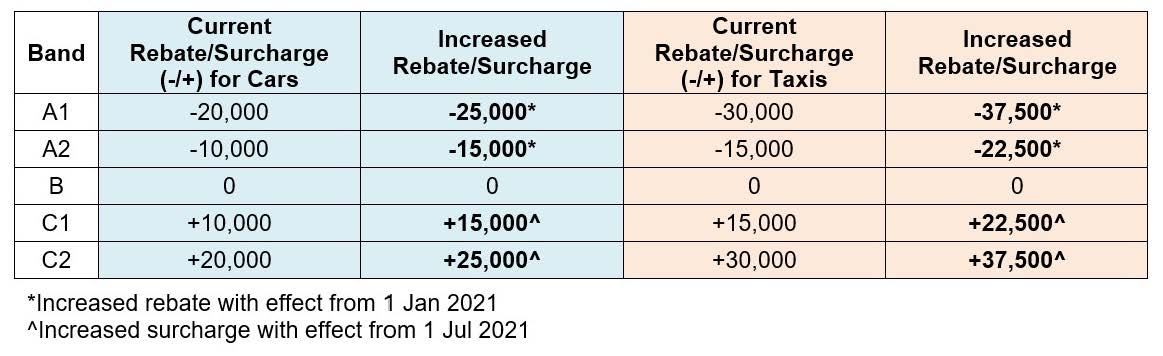

2 From 1 January 2021, the rebates for vehicles in both Bands A1 and A2 will be increased by $5,000 for cars, and $7,500 for taxis[1]. This means a car in Band A1 will enjoy a $25,000 rebate instead of $20,000, and a car in Band A2 will enjoy a $15,000 rebate instead of $10,000.

3 With the enhanced VES, coupled with the Electric Vehicle Early Adoption Incentive (EEAI)[2], commencing on 1 Jan 2021, buyers will be able to enjoy combined cost savings of up to $45,000 when they purchase a new fully electric car, and up to $57,500 for a new fully electric taxi (refer to Annex A for sample calculations). The higher savings will encourage EV adoption by further narrowing the upfront cost gap between electric cars and their Internal Combustion Engine (ICE) equivalents.

Increased Surcharges to Kick In on 1 July 2021

4 To allow time for the market to adjust, the surcharges for vehicles in both Bands C1 and C2 will be increased only from 1 July 2021, by $5,000 for cars, and $7,500 for taxis. Between 1 July 2021 and 31 December 2022, a car in Band C1 will incur a surcharge of $15,000 instead of $10,000, and a car in Band C2 will incur a surcharge of $25,000 instead of $20,000. There will be no change in the pollutant criteria for each VES band for the duration of the enhanced scheme (refer to Annex B for the new VES schedule).

5 The changes to the VES rebate/surcharge structure are shown in the table below.