- VES to be extended with adjustments to incentivise electric vehicles only

- Extension of EEAI until end 2026 at a revised cap of $7,500 and ceasing of EEAI thereafter

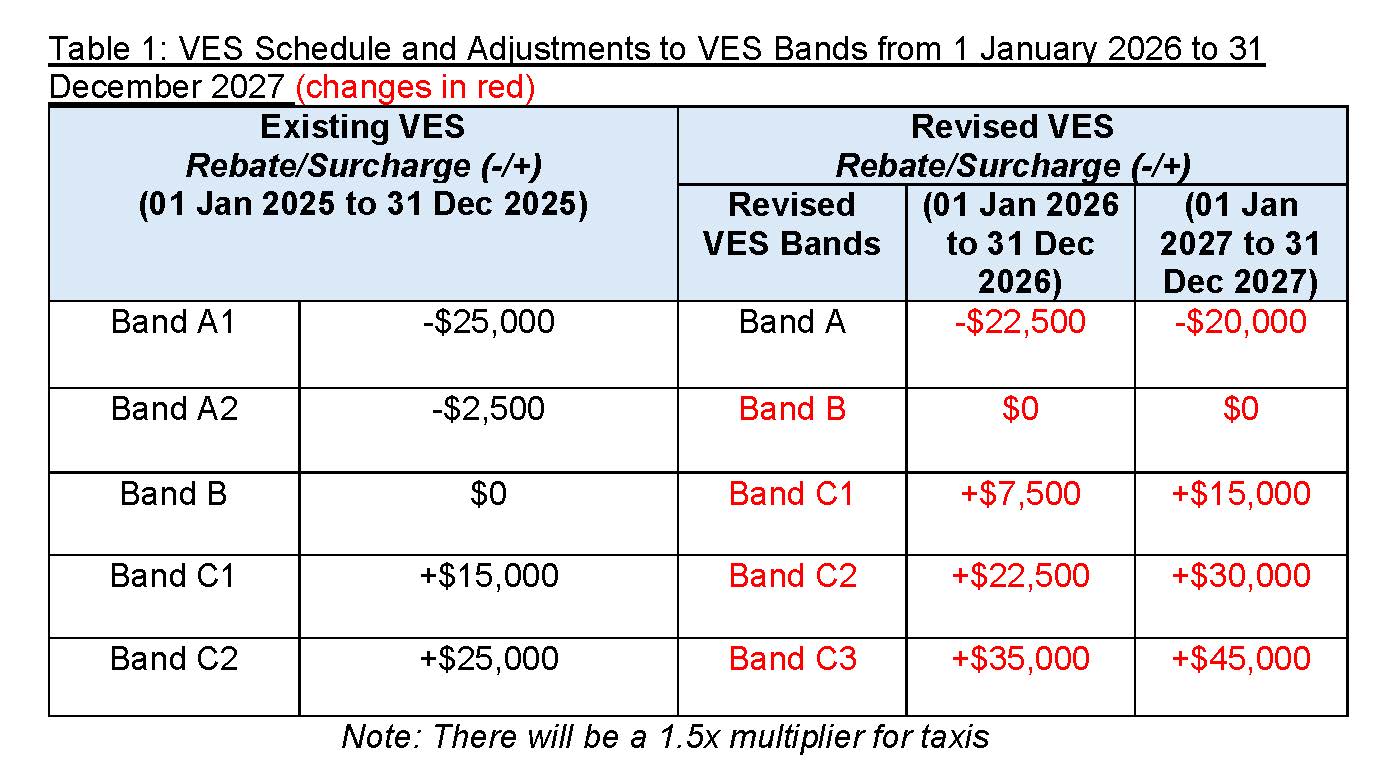

To support Singapore’s vision of 100% cleaner-energy vehicles by 2040[1], the Land Transport Authority (LTA) and the National Environment Agency (NEA) will extend the Vehicular Emissions Scheme (VES) from 1 January 2026 to 31 December 2027, with revisions to its banding, rebates and surcharges. The Electric Vehicle (EV) Early Adoption Incentive (EEAI) will be extended until 31 December 2026 and be ceased from 1 January 2027.

2. The VES and EEAI have supported the adoption of cleaner energy vehicles, which has been on an upward trend over the past few years. From January to August 2025, 80% of newly registered cars and taxis were cleaner energy models with about half being electric models. This is encouraging as EVs do not generate tailpipe emissions and are the cleanest vehicle option.

Extension of Vehicular Emissions Scheme (VES) with adjustments to incentivise electric vehicles only

3. NEA will continue to support the take-up of electric cars, including taxis, by extending the VES[2] for another two years from 1 January 2026 to 31 December 2027 with revised bands, rebates and surcharges. Only EVs will receive rebates. Hybrid vehicles will no longer receive rebates, while more pollutive vehicles will have higher surcharges. Vehicles currently in Band A2 will fall into the neutral band B under the revised VES banding structure, while vehicles currently in Bands B, C1 and C2 will fall into revised Bands C1, C2 and C3 respectively. There is no change to pollutant thresholds and there will be a shift in the banding structure (see Annex A).