Read the LTA Annual Report 2024/25 here!

Find out how we continue to keep Singapore moving after 30 years, reshaping how we travel, bringing communities together and remaining at the heart of Singapore's journey forward.

A Singapore Government Agency Website

How to identify

A Singapore Government Agency Website

How to identify

Find out how we continue to keep Singapore moving after 30 years, reshaping how we travel, bringing communities together and remaining at the heart of Singapore's journey forward.

Welcome to

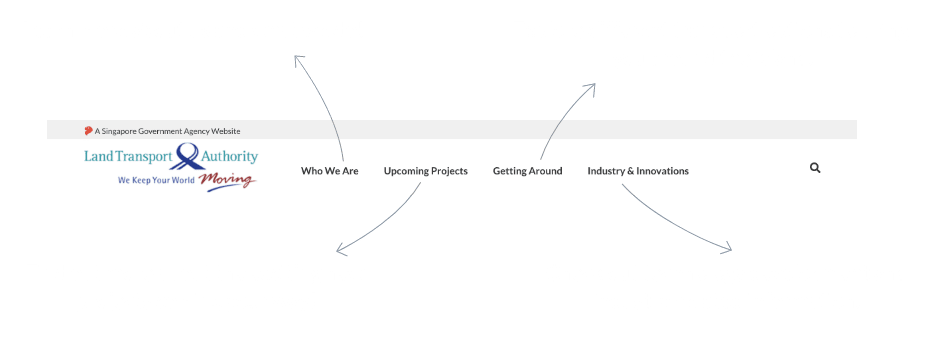

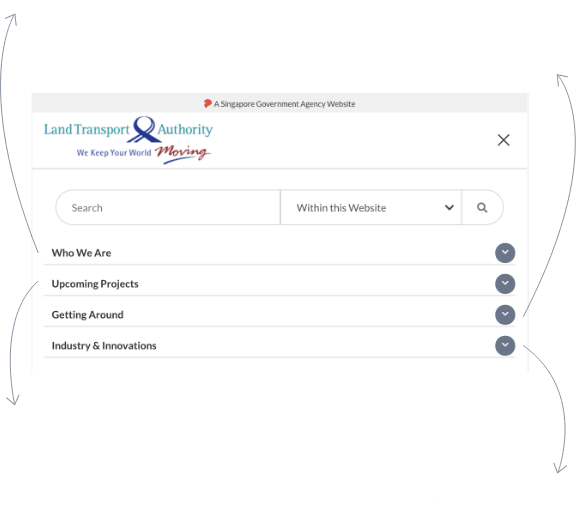

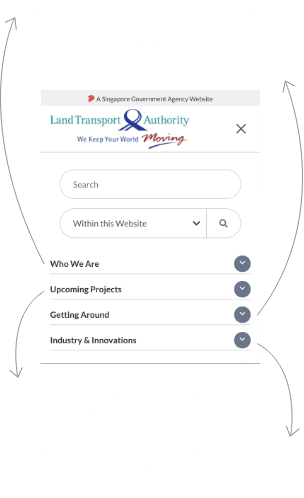

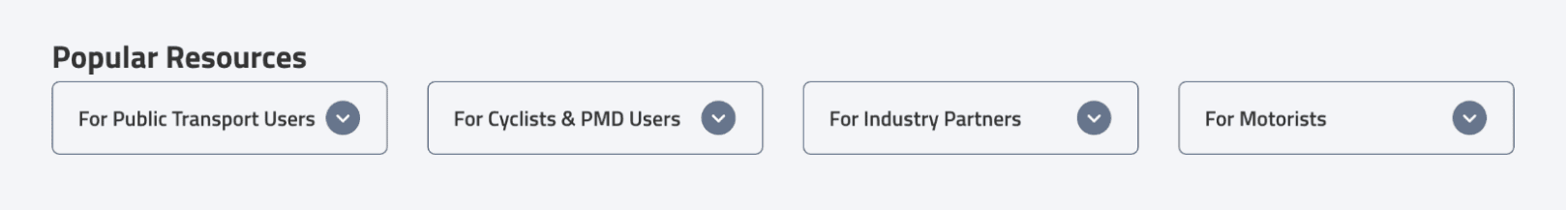

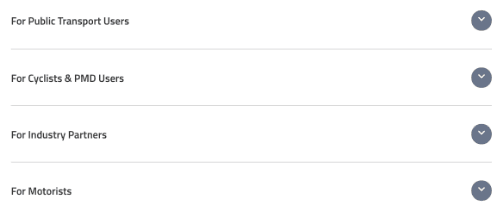

This quick tour will bring you through the key enhancements.

Use the links at the top navigation bar to help you find what you are looking for

Jump straight into the popular pages that

are most relevant to you

Taking a bus, train, or cycling to your

destination? Plan your routes and check

the fares using these tools!

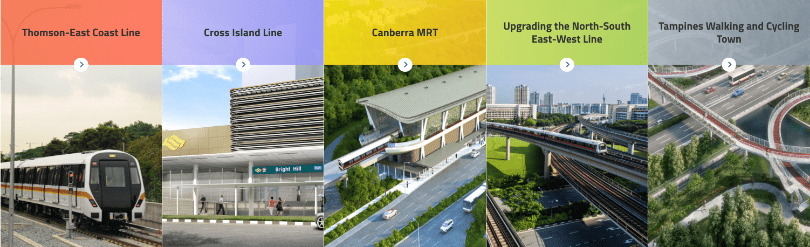

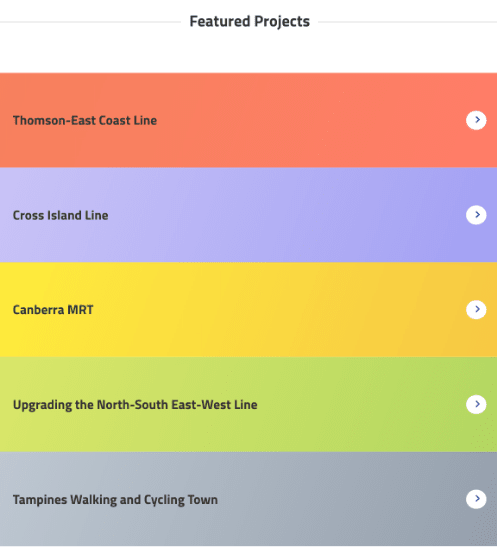

Our latest featured projects are just a click away!